Trending publication

M&A in Brief: Q4 2022

Print PDFHeadlines

1. Tax Issues for F Reorganizations in M&A Transactions

2. Presidential Executive Order Places Heightened Importance on National Security Risks and Committee on Foreign Investments in the United States Oversight

3. Delaware Exercises Business Judgment Rule

1. Tax Issues for F Reorganizations in M&A Transactions

By Christopher McLoon

F Reorganizations are used frequently in M&A transactions. Typically, they are used when a partnership (usually a private equity fund) (Fund) wishes to acquire the business of an S corporation (Target). In those cases, Target’s shareholders (Shareholders) are indirectly contributing some of their S corporation equity to a new partnership in exchange for partnership interests (the rollover). This article surveys typical deal structures for these transactions and tax issues arising from them.

I. Structures

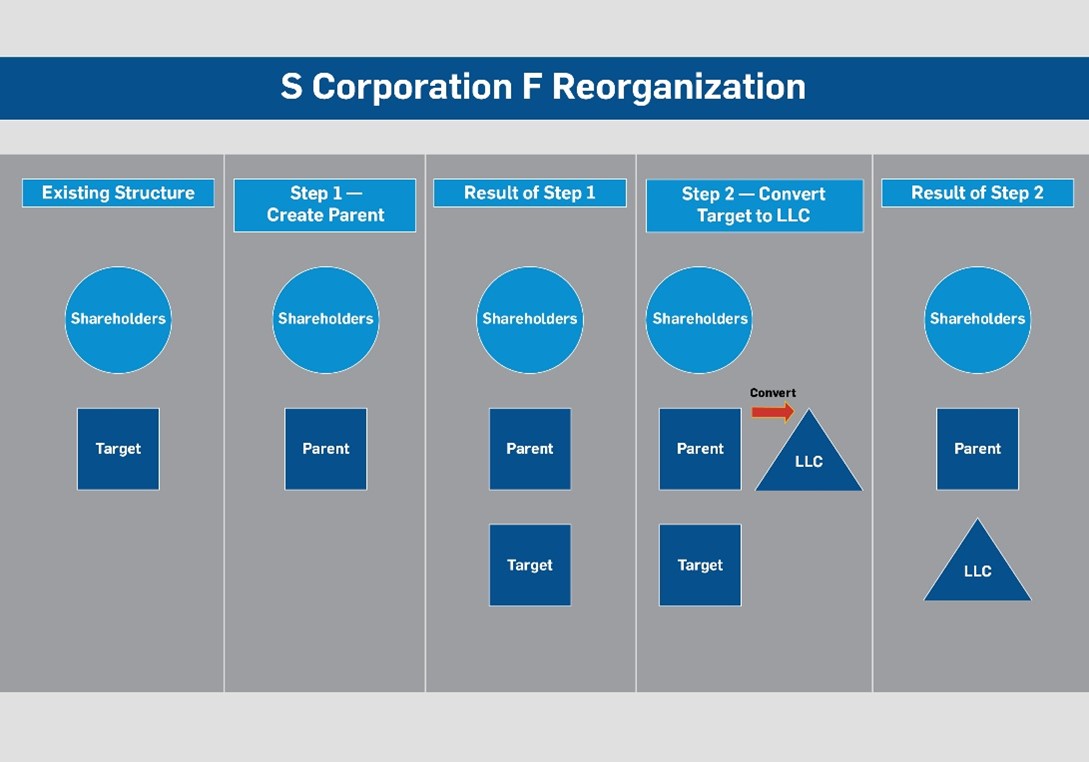

A. F Reorganization. The transaction begins with an F Reorganization. In this transaction, Shareholders contribute their Target stock to a new corporation (Parent) in exchange for Parent stock. Here’s an illustration:

B. Making Target A Q-Sub. Parent and Target elect to make Target a qualified S corporation subsidiary (a Q-Sub). Shortly thereafter, Parent causes Target to be converted to a new LLC. This LLC will initially be a disregarded entity.

C. Forming the Partnership. The new LLC is converted to a tax partnership (Target LLC). The conversion occurs once Target LLC has more than one member. Sometimes Fund becomes the second member. Sometimes another person becomes the second member. In either case, Fund will acquire Target LLC interests from Parent. Fund may also use debt financing to liquidate other Parent interests in Target LLC. When the dust settles on this step, Parent will own interests in Target LLC representing the rollover.

II. Tax Issues to Consider

A. F Reorganization. Shareholders want the reorganization to be tax-free. To accomplish this result, Shareholders must follow the rules governing F reorganizations carefully. Reasonable care should suffice.

B. Continuing S Corporation Status. If Target is an S corporation at the time of the reorganization, Parent will succeed to Target’s S corporation status, so Shareholders will continue to hold S corporation shares. However, if Target’s S election was not valid when made, or it terminated (inadvertently), then Parent will not succeed to Target’s S corporation status. If Parent is not an S corporation, Target cannot be a Q-Sub. For this reason, we usually recommend making a new S election for Parent effective on the reorganization date.

C. Gain to Corporation Shareholders. Shareholders want any equity “rollover” to be made tax-free. This happens only if the Target LLC interests remain with Parent. Further, Shareholders will achieve optimal results only if Parent remains an S corporation following the reorganization. Shareholders should take care to make sure that they comply with S corporation distribution and single class of stock requirements until the Target LLC interests are completely liquidated and proceeds are distributed.

D. Successor Tax Liabilities. Target is treated as though it were liquidated for tax purposes. However, Target’s historic tax liabilities remain with Target. Fund should be alert to risks related to these potential liabilities.

E. Bonus Depreciation. If Target has the right mix of assets, Fund can benefit from claiming bonus depreciation on some of those assets. If Fund is the second member of Target LLC, Fund is treated for tax purposes as though it acquired an undivided interest in each of Target LLC’s assets when it acquired Target LLC interests. That transaction should satisfy the purchase requirements for bonus depreciation. In addition, bonus depreciation regulations provide that bonus depreciation will be allocated solely to Fund. Parent will not benefit. The same result should also apply if Fund acquires Target interests after Target becomes a tax partnership. Bonus depreciation begins to phase out after 2022 and through 2026. After 2026, it will no longer be available…unless it is extended.

F. Amortizing Certain Intangibles. Target’s goodwill and going concern value is not amortizable to Target or Parent if they are “self-created” intangibles. Most often, they are. When Fund acquires an interest in Target LLC, the self-created intangibles can become amortizable in one of two ways.

First, if Fund is the second member of Target, the self-created intangibles will become amortizable only if Target elects to use the remedial allocation method for dealing with the intangibles built-in gain. Under the remedial allocation method, Fund can be allocated notional amortization deductions and Parent can be allocated corresponding notional income. Using the remedial allocation method is obviously a business point. It can significantly affect returns to Fund and Shareholders.

If, however, Target acquires interests in Target LLC after Target becomes a tax partnership, the self-created goodwill will become amortizable as to Fund alone if Target makes a section 754 election for the year of the acquisition. This approach obviates the need for remedial allocations. For this reason, we often advise our PE clients to acquire Target interests only after Target has become a tax partnership.

G. Debt-Financed Distributions. Fund can cause some of Parent’s interests in Target to be liquidated with proceeds from debt incurred by Target. This transaction element has some business points, but the tax points are actually pretty complex, because the debt-financed distributions can be treated as part of a disguised sale of property or Target interests. Each party to this transaction will want to consider planning how this transaction to avoid or mitigate the impact of disguised sale rules, and also to determine what property is sold in any such transaction.

2. Presidential Executive Order Places Heightened Importance on National Security Risks and Committee on Foreign Investments in the United States Oversight

By Kate Henry

As the mergers and acquisitions market remains active, the federal government is looking to provide increased scrutiny to certain foreign investors or buyers who may exacerbate certain threats to the United States’ national security. To address these concerns, on September 15, 2022, President Biden issued an Executive Order (the “Order”) providing direction to the Committee on Foreign Investments in the United States (“CFIUS”). This is the first Executive Order to address CFIUS and provide directives since its establishment in 1975. Specifically, President Biden directed CFIUS to focus on four specific areas of concern with respect to foreign investments in United States businesses when considering approval of transactions: the effect of foreign investment on certain supply chains that are critical to the economic health and national security of the United States; the threat of incremental investments by foreign investors that, in the aggregate, could lead to significant control over certain United States businesses; the threat of eroding cybersecurity measures applicable to United States companies due to increased access to U.S. systems and databases; and increased access by foreign investors to personally identifiable information of United States citizens.

Threat to Supply Chains

President Biden’s first directive to CFIUS is with respect to the effect of foreign investors on certain supply chains that are crucial to national security, such as manufacturing capabilities, services, critical mineral resources, and technologies that are critical to national security, such as microelectronics, artificial intelligence, biotechnology and biomanufacturing, and others. The Order underscores the critical role of certain supply chains to the United States’ economy and national security, and notes that increased foreign investment in certain U.S. companies that service these supply chains could provide foreign actors with the control to derail such supply chains or remove the United States from those supply chains altogether.

Specifically, the Order directs CFIUS to consider the United States’ capability to maintain key supply chains, the possibilities with respect to diversification of supply chains to ensure resiliency in the event of an identified weakness in a certain key supply chain, whether certain United States businesses that are party to transactions with foreign investors supply, either directly or indirectly, goods or services to the United States federal government, the energy sector, or the defense sector, and the concentration of ownership of certain crucial supply chains by foreign persons.

Incremental Investments Leading to Increased Control of U.S. Businesses by Foreign Persons

The Order goes on to discuss the importance of focusing on incremental investments by foreign persons in certain United States businesses that could ultimately result in foreign control or direction of the business. Specifically, the Order states: “A series of acquisitions in the same, similar or related United States businesses involved in activities that are fundamental to national security or on terms that implicate national security may result in a particular covered transaction giving rise to a national security risk when considered in the context of transactions that preceded it.” The Order warns of “ced[ing], part by part,” control of certain U.S. businesses that, either individually or in the aggregate, are crucial to the maintenance of national security. The Order urges CFIUS to consider globally the context of multiple investments by a foreign person in a series of businesses in the same or substantially similar industries, and to consider the aggregate threat posed by such significant ownership by foreign persons in a particularly sensitive business sector, such as manufacturing, critical mining resources, or certain technologies.

The Order goes on to indicate that CFIUS may request, as part of their review of any particular covered transaction, “an analysis of the industry or industries in which the United States business operates, and the cumulative control of, or pattern of recent transactions by, a foreign person, including, directly or indirectly, a foreign government, in that sector or industry.”

Potential Erosion of U.S. Cybersecurity in the Wake of Increased Foreign Investment

The Order also highlights the importance of preventing the erosion of U.S. cybersecurity in light of increased foreign investments in certain U.S. businesses crucial to national security. In particular, the Order touches on the potential for attacks and cyber intrusions that could occur with increased control by foreign persons with aims to disrupt or circumvent the U.S. federal government’s cybersecurity measures. The Order implores CFIUS to consider whether a certain covered transaction has the capability of providing a foreign person with the access and/or opportunity to impair national security by exploiting certain weaknesses or providing privileged access to sensitive technological systems that could result in the disruption to certain technology frameworks that could affect cybersecurity.

Specifically, the Order directs CFIUS to “consider, as appropriate, whether a covered transaction may provide a foreign person who might take actions that threaten to impair the national security of the United States as a result of the transaction, or their relevant third-party ties that might cause the transaction to pose such a threat, with direct or indirect access to capabilities or information databases and systems on which threat actors could engage in malicious cyber-enabled activities affecting the interests of the United States or United States persons . . . .”

Security Risks Posed by Foreign Persons’ Access to Sensitive Personally Identifiable and Other Sensitive Confidential Information

The last major topic addressed by the Order is the potential for foreign persons to access confidential information of U.S. citizens. Specifically, increased foreign investment in and control of U.S. businesses could result in foreign control of businesses possessing certain sensitive information, putting United States citizens in a compromised position. Increased investments and purchase activity by foreign persons could lead to access to larger data pools, which in turn could allow foreign persons the ability to de-classify or re-identify certain individuals through combined use of otherwise confidential personally identifiable data.

In order to prevent this risk, the Order directs CFIUS to consider whether foreign investments in certain businesses that may have access to such sensitive personally identifiable information are putting such businesses at risk of having that sensitive data misused in order to put the United States’ national security at risk.

U.S. Businesses and Cross-Border Transactions Going Forward

Businesses and their advisors involved in cross-border transactions will need to consider the Order when planning and structuring these transactions. It is clear that the government will take a closer look at any covered transaction involving topics covered by the Order than they have historically, and parties to these transactions will need to anticipate a more stringent review. Failure to anticipate a longer review period or requests for additional information may delay or derail potential transactions.

3. Delaware Exercises Business Judgment Rule

By Mark Tarallo and Mary Moran

All corporate directors owe fiduciary duties of care and loyalty to their corporations and the stockholders of those corporations. When faced with a claim for the breach of duty of care, Delaware courts will review the defendant directors’ conduct using one of two standards of review: the Business Judgment Rule (the “BJR”) or, if the necessary requirements are met, the entire fairness standard.

In a recent case, Manti Holdings LLC et al., v. The Carlyle Group Inc. et al, No. 2020-0657-SG (Del.Ch. June 30, 2022) the Delaware Chancery Court reviewed both the BJR and entire fairness standard. The court’s decision to deny the director defendants’ motion to dismiss provides another example of how plaintiff stockholders can overcome the BJR hurdle, and how the conduct of defendant directors may fall short when analyzed under the entire fairness standard.

The Business Judgment Rule and Entire Fairness Standard Explained

The BJR provides for a strong presumption that, in making business decisions, directors of a corporation “acted on an informed basis, in good faith, and in the honest belief that the action was in the best interest of the company.” Under this presumption, an “independent and disinterested” director cannot be held liable for any corporate loss unless the court finds that no director attempting the meet their duty in good faith would authorize such a transaction. In considering whether a director is “independent and disinterested” a court will inquire into whether a “conflicted controller transaction” existed. A conflicted controller transaction arises either in: (a) transactions where the controller stands on both sides; or (b) transactions where the controller competes with the common stockholders for consideration. Scenario (b) describes a transaction in which a controller (i) receives greater monetary consideration for its shares than the minority stockholders, (ii) takes a different form of consideration than the minority stockholders, or (iii) extracts something uniquely valuable to the controller, even if the controller nominally receives the same consideration as all other stockholders.

If plaintiff stockholders can show that a director was not “independent and disinterested,” the burden of proof shifts to the director defendants to prove that the transaction was entirely fair. In such instances, a court will apply the entire fairness standard, which requires a fact intensive inquiry into two related concepts: fair dealing and fair price. The concept of “fair dealing” relates to the process by which the transaction was negotiated (i.e., timing, structure, obtaining of director and stockholder approval). The concept of “fair price” refers to the economic terms of the transaction.

Manti Holdings Chancery Court Ruling

In Manti Holdings, the Delaware Chancery Court considered minority stockholder claims against three directors of Authentix Inc. (the “Company”) and the Company’s majority holder The Carlyle Group Inc., a private equity firm (the “Carlyle Group”) for breach of their fiduciary duties when they approved the $77.5 million sale of the Company. This sale price was determined during a time when the Company’s value was depressed due to contract renewal uncertainties, all of which were resolved by the time of the closing of the transaction. Notwithstanding the increase in the Company’s value and requests from one of the dissenting board members, the board of directors of the Company did not attempt to renegotiate the sale price or pause negotiations until a higher bid was received. This failure was allegedly due to pressure on the Carlyle Group to sell the Company and make returns to its investors quickly. Notably, the Carlyle Group had two representatives on the Company’s board of directors.

The terms of the sale, together with the Company’s governing documents, provided for the holders of preferred equity (which included the Carlyle Group) to recoup their investments in receiving the first $70 million of net sale proceeds. Meanwhile, the common stockholders were to receive little to nothing for their stock, receiving whatever remained of the sale price after the preferred stockholders were paid.

In overcoming the initial BJR presumption, the plaintiff stockholders alleged, and the Chancellor agreed, that the entire fairness standard of review should apply because: (1) the sale amounted to a conflicted controller transaction as the Carlyle Group received a unique benefit from closing the sale by a certain date, which rendered it conflicted; and (2) the sale was not approved by an independent and disinterested board.

Finding that the presumption of the BJR had been sufficiently rebutted, the court, applying the entire fairness standard, held that the complaint cleared the burden of proof in pleading “some facts” supporting that there existed an unfair process or price. The stockholders argued that the sale price failed to reflect the Company’s resolved contract renewal uncertainties. Further, the stockholders pled that the Carlyle Group, as majority stockholder and having two board representatives, expressed a strong desire to close the sale quickly, in efforts to benefit themselves. Finally, the sale was never approved by an independent special committee of the board of directors or by the Company’s minority stockholders. The Court held that under the alleged facts, it was reasonable to determine that the sale did not reflect a fair process or a fair price.

Considerations for Corporate Directors

To maintain protection under the BJR and avoid falling short under the entire fairness standard, corporate directors can take the following actions:

- Stay informed: Directors have a duty to take the necessary steps to make informed business decisions by reviewing all material information reasonably available to them. Actions items include attending meetings, reading reports and other material prepared for the board, asking questions at meetings, and relying on competent consultants.

- Only act in “good faith”: A director must act with honesty of purpose and in the best interest of the corporation. While no set definition of good faith exists, courts have held that the following amount to bad faith: (a) failing to act or consciously disregarding one’s duties (ex: a director knows management is violating corporate policy but makes no attempt to change the situation); (b) knowingly allowing the company to violate the law; (c) knowingly violating a provision of the company’s charter; or (d) a complete abandonment of a directorial duty.[1]

- Seek approval from “disinterested” directors or minority stockholders: In instances where a transaction could be deemed a conflicted controller transaction, directors should comply with two procedural protections that will force the application of the BJR, rather than the entire fairness standard. To comply with the dual procedural protections, the transaction must have been conditioned upfront on the approval of both: (1) an independent, fully functioning special committee of the board; and (2) an uncoerced and informed vote by a majority of the minority stockholders.[2]

1 Fiduciary Duties of the Board of Directors, Practical Law Practice Note Overview 6-382-1267

2 In re MFW S’holders Litig., 67 A.3d 496, 500 (Del. Ch. 2013)

This update is for information purposes only and should not be construed as legal advice on any specific facts or circumstances. Under the rules of the Supreme Judicial Court of Massachusetts, this material may be considered as advertising.