Trending publication

Breaking Down the “One, Big, Beautiful” Tax Bill: Take One

Print PDFOn May 12, the Republican majority leadership in the House of Representatives released for consideration its tax and spending reconciliation legislation, called the “One Big, Beautiful Bill” (the “Bill”). This major piece of legislation aims to do many things, among them: extending much of the expiring tax provisions contained in the 2017 Tax Cuts and Jobs Act (the “TCJA”), repealing many of the energy and environmental incentives enacted by the Inflation Reduction Act of 2022, increasing the exclusion amount for estate and gift tax, enacting major structural changes to the tax-exempt sector through the imposition of corporate-level taxes on investment gains of university endowments and foundations, significantly cutting Medicaid spending, and reversing, to some extent, the limitation on the deduction for state and local taxes (“SALT”). By the end of last week, it had been marked-up and approved by the House Ways and Means Committee, but failed to move out of the House Budget Committee. After a weekend of negotiations, it moved out of the House Budget Committee late on May 18, and it is on a path for a full House vote later this week. While some of the provisions of the Bill continue to be in flux, we are publishing this advisory to give our readers a sense of the goals of House Republicans with respect to the legislation and where things stand at the moment. While this legislation aims to have a comprehensive effect on both the taxing and spending sides of the federal budget, this advisory will focus on highlights of the current tax provisions.

Unless otherwise noted, the effective date of each of the provisions below would be for taxable years beginning after December 31, 2025.

BUSINESSES (CORPORATIONS AND PASS-THROUGHS)

- Qualified Business Income. The Bill would make permanent the deduction for qualified business income under section 199A of the Internal Revenue Code (the “Code”) and would increase the deduction from 20% to 23%. In addition, the Bill would extend eligibility for the deduction to include qualified business development corporation interest dividends in calculating the combined qualified business amount.

- Special Depreciation Allowance for Certain Property. The Bill would extend and modify the additional first year depreciation deduction through 2029 and increase the allowance to 100% for property acquired and placed in service after January 19, 2025, and before January 1, 2030.

- Domestic Research and Experimental Expenditures. In a change sought by many technology companies, the Bill would suspend required capitalization of domestic research or experimental expenditures for amounts paid or incurred in taxable years beginning after December 31, 2024, and before January 1, 2030, and would offer taxpayers a choice of methods for write off of such expenses.

- Business Interest Deduction. The EBITDA limitation under Section 163(j) would be reinstated for taxable years beginning after December 31, 2024, and before January 1, 2030. As a result, the interest deduction under the section 163(j) limitation for these years would be computed without regard to the deduction for depreciation, amortization, or depletion.

- Special Depreciation Allowance for Qualified Production Property. An elective 100% depreciation allowance would be allowed for qualified production property, which is any portion of nonresidential real property that meets certain requirements, including use by the taxpayer as an integral part of a qualified production activity.

- Qualified Opportunity Zones. Several favorable changes would be made to the provisions of the Code on qualified opportunity zones, including allowing for the designation of additional qualified opportunity zones under a modified definition of low-income community and modifying the opportunity zone investment incentive, in effect from January 1, 2027, through December 31, 2033, under rules similar to those for the initial designation.

- 1099 Information Reporting. The information reporting threshold for certain payments to persons engaged in a trade or business and for remuneration for services would be increased to $2,000 in a calendar year, with that amount to be indexed annually for inflation in years after 2026. The proposal also would align the backup withholding dollar threshold with the new $2,000 reporting threshold.

- Expensing Certain Depreciable Business Assets. The Bill would increase the maximum amount that can be expensed under section 179 of the Code to $2.5 million and increase the phaseout threshold amount to $4 million.

- Entity Aggregation Rules under Section 162(m). Under current law, certain public companies are disallowed an income tax deduction for compensation paid to certain covered employees in excess of $1,000,000 per year. Current section 162(m) of the Code does not include any entity aggregation rules. The Bill would propose aggregation rules for purposes of calculating the deduction limit that would apply to a publicly held corporation that is a member of a controlled group.

- Charitable Contribution Deduction Floor. Under current law, corporations are allowed an income tax deduction for their charitable contributions of up to 10% of their taxable income. The Bill would require a corporation to contribute at least 1% of its taxable income to charitable organizations before being allowed a charitable income tax deduction.

- Cessation of ERTC Refund Claims and Retroactive Expansion of Promoter Penalties. The Bill would enhance the tight scrutiny being placed on the COVID-era relief provision, called the Employee Retention Tax Credit (“ERTC”), which provided payroll tax relief for certain employers who could show that their businesses were affected by COVID. The provision was designed to support employers who were retaining employees in the face of the economic uncertainty of the COVID-19 pandemic. As implemented, this tax credit saw much abuse by so-called ERTC promoters. The Bill would, among other provisions, bar payroll tax refund claims under the ERTC for claims filed after January 31, 2024 and extend the statute of limitations for review of claims made. It also would add the concept of “ERTC promoter” and impose retroactive penalties on certain advisors who based their compensation on the amount of a refund received.

- Phaseout and Repeal of Energy Incentives. The Inflation Reduction Act of 2022 provided tax credits and other benefits to encourage the production and sale of so-called clean energy; this Bill would phase out and repeal those incentives. Provisions that would be affected include the clean fuel production credit, clean electricity production credit, investment tax credit, zero-emission nuclear power production credit, and advanced manufacturing production tax credit. The rollback of these provisions would be accelerated for certain foreign entities. These provisions reportedly are among the provisions that have been the subject of intense negotiation among House Republican leadership and House Republicans who voted against the Bill on May 16, when it was before the House Budget Committee, and are expected to change.

NONPROFIT ORGANIZATIONS

Nutter’s Nonprofit and Social Impact Practice Group will continue to closely monitor developments as they relate to nonprofit organizations and to provide further updates in its The Real Impact newsletter.

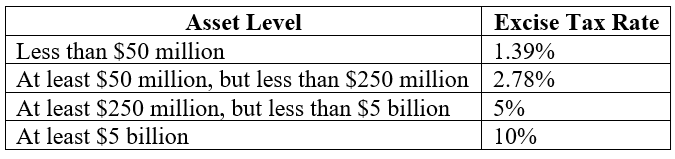

- Increase of Net Investment Income Tax of Certain Private Foundations. Currently, private foundations are subject to a flat excise tax of 1.39% on their net investment income under section 4940 of the Code. The Bill would increase the excise tax rate on certain private foundations, based on their asset level, as follows:

This provision would be effective for taxable years beginning after the date the Bill is enacted.

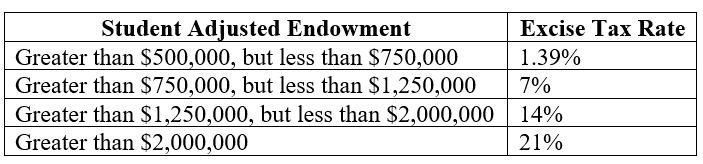

- Increase of “Endowment Tax” on Private Colleges and Universities. Currently, the net investment income of certain private colleges and universities is subject to a 1.4% excise tax under section 4968 of the Code. These colleges and universities generally include those that have:

- At least 500 tuition-paying students;

- More than 50% of the tuition-paying students located in the United States; and

- Assets with a fair market value of $500,000 or greater per student ("student adjusted endowment").

The Bill would adjust the tax from a flat rate to a tiered rate, depending on an institution's student adjusted endowment, as follows:

Under current law, international students count in determining the student adjusted endowment. Under the Bill, international students generally would no longer count, meaning higher student adjusted endowments for institutions with an international student population. The Bill also would include a carve-out from the tax for certain religious institutions.

- Termination of Tax-Exempt Status of Terrorist Supporting Organizations. In the spring edition of The Real Impact published last week, the Nonprofit and Social Impact Practice Group discussed the general procedure for revoking an organization’s tax-exempt status, which generally occurs only after the IRS conducts an examination (unless the revocation is due to failure to file returns for three consecutive years). Under current section 501(p) of the Code, however, an organization’s tax-exempt status may be suspended during the period during which it is designated by federal authorities (including in certain Presidential executive orders) as a terrorist organization. The Bill would expand the reach of section 501(p). The proposal would make 501(p) apply to both terrorist organizations and terrorist supporting Terrorist supporting organizations would be defined as any organization designated by the Secretary of the Treasury as having provided, during the three-year period ending on the date of such designation, “material support or resources” to a terrorist organization or another terrorist supporting organization. The Bill also would provide for a notice requirement and cure period and outline other processes relating to designation as a terrorist supporting organization. This proposal would be effective for designations made after the date of the Bill’s enactment.

- Unrelated Business Taxable Income (“UBTI”). There are a few changes to the calculation of UBTI proposed in the Bill. First, expenses for qualified transportation fringe benefits (e.g., employer provided parking) would be UBTI. Second, the Bill would remove from the UBTI royalty-exclusion royalty income generated from the licensing of a tax-exempt organization’s name or logo. Third, the Bill would clarify that income derived from certain fundamental research would be excludable from UBTI only if it is made available to the general public.

- Excess Business Holdings. Under the Bill, certain non-publicly traded stock repurchased by a business from an employee stock ownership plan would not affect a private foundation’s excess business holdings under section 4943 of the Code. This provision would be effective for taxable years after the date of the enactment of the Bill and for purchases made by a business of voting stock in taxable years beginning after December 31, 2019.

- Section 4960 Compensation Limit. The Code currently imposes an excise tax on tax-exempt employers that either pay (1) over $1,000,000 in compensation or (2) an excess parachute payment to the five highest compensated employees (“covered employees”). The Bill would broaden the definition of covered employee to any employee or former employee.

INTERNATIONAL

- Certain Foreign Intangible Income. The Bill would lower the preferential rates on Global Intangible Low-Taxed Income (“GILTI”) and Foreign-Derived Intangible Income (“FDII”) by increasing the deduction for corporations, from 37.5% to 50% of their GILTI and from 21.875% to 37.5% of their FDII.

- Tax Increase on U.S.-Source Income Earned by Tax Residents of Foreign Countries that Impose “Unfair” Foreign Taxes. The Bill would introduce a significant tax increase on residents of foreign countries that impose taxes designated as “unfair.” Unfair taxes include an undertaxed profits rule, a digital services tax, a diverted profits tax, and potentially other taxes identified by the Treasury Secretary. The tax increase would apply to U.S. taxes on the sale of U.S. real estate and on certain other U.S.-source income, such as dividends from U.S. companies. The tax increase could apply even to residents of countries that have negotiated lower tax rates under an existing double taxation treaty with the United States. The tax increase would begin to apply on the later of (1) 90 days after the beginning of the year following the year in which the Bill is enacted; (2) 120 days after the date the particular foreign country enacts a tax that is determined to be unfair; or (3) the date on which an unfair foreign tax begins to apply.

- Excise Tax on Payments to Persons Located Abroad. The Bill would introduce a 5% excise tax on “remittance transfers,” which are defined as electronic transfers of funds to any person located in a foreign country. Although the tax is imposed on the sender of the transfer, the financial institution or other person through which the transfer is made (the “transfer provider”) would be secondarily liable for the tax and responsible for collecting it. An exception to this tax would apply to transfers made by U.S. citizens and nationals, but only if the transfer provider fulfills certain due diligence requirements aimed at ensuring the sender is a U.S. citizen or national.

INDIVIDUALS

- Individual Tax Rates. The Bill would make permanent the regular income tax rate schedules for individuals, estates, and trusts enacted in the TCJA, modifying the bracket thresholds for inflation. Notably, there are no proposed changes to the taxation of carried interests.

- No Tax on Tips. The Bill would propose a new federal income tax deduction equal to the “qualified tips” that an individual receives. “Qualified tips” refers to any cash tip received by an individual in an occupation which traditionally and customarily receives tips. The Secretary of the Treasury would publish a list of qualifying occupations within 90 days of the proposal’s enactment. This provision would apply to taxable years beginning after December 31, 2024, and would expire for taxable years beginning after December 31, 2028.

- No Tax on Overtime. The Bill would introduce a new federal income tax deduction equal to the “qualified overtime compensation” that an individual receives. “Qualified overtime compensation” refers to the overtime compensation paid to an individual required under section 7 of the Fair Labor Standards Act of 1938 that is in excess of the regular rate at which the individual is employed. The overtime deduction would not include (1) any qualified tips and (2) any amount received by a highly compensated employee. This provision would apply to taxable years beginning after December 31, 2024, and would expire for taxable years beginning after December 31, 2028.

- SALT Deduction Cap and Workaround: The Bill would propose to extend the cap on the income tax deduction for SALT, but to raise the cap from $10,000 to $30,000 and to phase out the deduction entirely at $400,000. While the entire Bill is subject to change, this provision, in particular, continues to be heavily negotiated among members of Congress and is expected to change. This cap was first introduced in the TCJA. In response, many taxpayers adopted so-called workaround provisions to lessen the impact of the cap. This Bill would curtail the ability to adopt the workaround strategies.

- Extension of Increased Standard Deduction. The temporary increases to the standard deduction enacted by the TCJA would no longer expire, and the standard deduction would be temporarily increased to $16,000 for unmarried individuals and married individuals filing separate returns, $24,000 for heads of households, and $32,0000 for married individuals filing joint returns and surviving spouses for taxable years beginning after December 31, 2024, and before January 1, 2029.

- Termination of Deduction for Personal Exemptions. The amount of the personal exemption would be permanently reduced to $0.

- Enhanced Deduction for Seniors. Individuals who reach the age of 65 would have a deduction for a bonus additional amount of $4,000 for taxable years beginning after December 31, 2024, and before January 1, 2029. The bonus amount would phase out for taxpayers with income over a threshold amount of $150,000 for taxpayers filing jointly and $75,000 for all other taxpayers.

- Extension of Increased Alternative Minimum Tax (“AMT”) Exemption and Phase-Out Thresholds. The TCJA’s increase in the AMT exemption amounts and phase-out thresholds would no longer expire.

- Extension of Limitation on Deduction for Qualified Residence Interest. A provision of the Bill would make permanent the $750,000 ($375,000 in the case of a married individual filing separately) limitation on acquisition indebtedness. Additionally, it would make permanent the exclusion of interest on home equity indebtedness.

- Extension of Limitation on Exclusion and Deduction for Moving Expenses. The Bill would permanently repeal the deduction for moving expenses, except in the case of a member of the Armed Forces (or their spouse or child), and the qualified moving expense reimbursement exclusion, except in the case of a member of the Armed Forces on active duty who moves because of a military order or permanent change of station.

- No Tax on Car Loan Interest. Unless disallowed under another rule, the proposal would allow for a phased-out deduction for qualified passenger vehicle loan interest for taxable years 2025 through 2028. “Qualified passenger vehicle loan interest” refers to any interest on indebtedness for the purchase of, and that is secured by a first lien on, a passenger vehicle whose final assembly occurs in the U.S. for personal use, subject to a cap of $10,000.

- Charitable Contribution Deduction for Non-Itemizers. The Bill would reinstate a partial charitable contribution deduction for individual taxpayers who do not itemize their deductions. The maximum deduction for taxpayers who are married filing jointly would be $300 and for all other taxpayers would be $150. This deduction would be available for taxpayers beginning in the 2024 taxable year.

- Tax Credit for Contributions to Scholarship Granting Organizations. Under current law, charitable contributions to scholarship-granting organizations are treated like any other charitable contribution. The Bill would create a nonrefundable income tax credit for charitable contributions to certain organizations that grant scholarships to elementary and secondary schools. The credit would be equal to the aggregate amount of qualified contributions made during the taxable year, limited to the greater of (1) $5,000 or (2) 10% of the taxpayer’s adjusted gross income.

- Extension of Increased Child Tax Credit. The maximum child tax credit would be temporarily increased to $2,500 for taxable years beginning after December 31, 2024, and before December 31, 2028, following which the maximum child tax credit would revert to a permanent amount of $2,000.

- Enhancement of Adoption Tax Credit. Up to $5,000 of the adoption tax credit—an income tax credit for the amount of qualified adoption expenses that a taxpayer pays or incurs—would be refundable. “Qualified adoption expenses” include reasonable and necessary adoption fees, court costs, attorney fees, and other expenses that are directly related to and have as their principal purpose a taxpayer’s legal adoption of a child.

WEALTH TRANSFER TAXES

- Extension of Increased Estate and Gift Tax Exemption Amounts and Permanent Enhancement. The Bill would increase the federal estate and gift tax exclusion amount—the amount that can be transferred free of federal gift and estate tax—to $15,000,000. This change would result also in a commensurate increase in the generation-skipping transfer tax exemption amount. Unlike the current exclusion amount ($13,990,000), which is otherwise scheduled to revert to approximately $7,000,000 at the end of 2025, the proposed increase does not have a scheduled sunset date. Like the current exclusion amount, the proposed exclusion amount would be adjusted yearly for inflation.

- MAGA Accounts. The Bill would introduce a new type of tax-advantaged account, a “MAGA account,” which aims to assist parents in setting aside funds for their children. The following rules would apply to a MAGA account:

- It must be funded before the child for whose benefit it is established reaches the age of 18; and

- The maximum amount that can be contributed to a MAGA account per year is $5,000, adjusted for inflation.

The income earned on the assets held in a MAGA account would not be taxed until funds are withdrawn or used for the benefit of the account’s beneficiary. Income distributions generally would be taxed as ordinary income, but if the income is used for qualified educational expenses, it would be taxed as capital gains. The tax rate on income distributions is increased by 10% if the recipient has not reached the age of 30. Once the beneficiary turns 31, the beneficiary is treated as receiving the funds in the account.

The Bill would also establish a pilot program for MAGA accounts, whereby the Treasury would provide a $1,000 credit for any existing MAGA account for a child born in 2025 through 2028 or, if a child born in those years is not the beneficiary of an existing MAGA account, the Treasury would establish an account for that child and fund it with $1,000.

EMPLOYEE BENEFITS

- Individual Coverage Health Reimbursement Accounts (“ICHRAs”)/CHOICE Arrangements. The Bill would codify the 2019 regulations permitting employer-offered ICHRAs (which would be rebranded as Custom Health Option and Individual Care Expense (“CHOICE”) arrangements) to purchase qualified health insurance on the individual market (the “Exchange”) and medical expenses. Employees enrolled in CHOICE arrangements would be permitted to pay for health plan premiums purchased through the Exchange on a pre-tax basis. For small businesses (i.e., those with fewer than 50 employees) that extend CHOICE arrangements for the first time, a new two-year tax credit would be available (equal to $100 per employee, per month for year one, and $50 per employee, per month for year two).

- Changes Applicable to Health Savings Accounts (“HSAs”). The Bill includes multiple provisions related to HSAs that would:

- Increase HSA annual contribution limits; for individuals making less than $75,000 per year, an additional annual contribution of up to $4,300 would be permitted and for families making less than $150,000 per year, an additional annual contribution of up to $8,550 would be permitted; such limits would be indexed for inflation and phased out for individuals making $100,000 per year and families making $200,000 per year

- Make working individuals eligible for Medicare Part A, but enrolled in a high deductible health plan (a “HDHP”), eligible to contribute to an HSA; the HSA rules that apply to individuals under age 65 would extend to this group

- Make health insurance plans on the Exchange that are considered bronze or catastrophic plans eligible plans for making HSA contributions

- Make physical fitness memberships and instructional physical activity a qualified medical expense; there would be a limit of $500 per year for an individual and $1,000 per year for family

- Allow, if the employer permits, an employee that is newly enrolled in a HDHP to convert flexible spending account (an “FSA”) and/or health reimbursement account (“HRA”) balances into an HSA; the conversion amount would be capped at the FSA contribution limit

- Allow eligible qualified medical expenses incurred within 60 days prior to establishing an HSA to be paid with HSA funds

- Make individuals eligible for an HSA even if the individual’s spouse is enrolled in an FSA

- Permit an individual with a HDHP to also enroll in a direct primary care (a “DPC”) arrangement and pay for DPC services with HSA funds provided that the HSA distributions for such services that do not exceed certain limits (i.e., $150 per month for individuals and $300 per month for families, as adjusted for inflation)

- Allow both spouses (if HSA-eligible) to make catch-up contributions into the same HSA account

- Enhancement of Employer-Provided Child Care Credit. The Bill would increase the employer-provided child care credit to 40% of qualified child care expenditures (50% for eligible small businesses) in addition to 10% of qualified referral expenses allowed under present law, with a total credit limit increased to $500,000 ($600,000 for small businesses).

- Extension and Enhancement of Paid Family and Medical Leave Credit. The Bill would extend the paid family and medical leave credit permanently and would allow the credit to be claimed for an applicable percentage of premiums paid or incurred by an eligible employer during a taxable year for insurance policies that provide paid family and medical leave for qualifying employees.

Where do we go from here?

We are just at the starting point in the journey for this legislation to be enacted into law. Currently ongoing are negotiations among House Republicans with regard to many provisions, including Medicaid spending levels, the extent and speed of the rollback of energy and environmental tax incentives, and the SALT deduction cap. If the leadership in the House of Representatives succeeds in bringing the Bill to a favorable vote this week, it will then head to the Senate, where changes are almost certain to be made. We continue to track and assess the impact on all types of taxpayers and will continue to keep you apprised of these changes.

This advisory was prepared by members of Nutter’s Tax and Private Client Departments. If you would like additional information, please contact one of our Tax or Private Client attorneys or your Nutter attorney at 617.439.2000.

This update is for information purposes only and should not be construed as legal advice on any specific facts or circumstances. Under the rules of the Supreme Judicial Court of Massachusetts, this material may be considered as advertising.